For you interested in investing in Japanese stocks, I introduce one of leading companies in Japan!

The financial performance and financial condition of the company are presented in charts and graphs.

I hope you’ll use it to your investment advantage!

Today, I will introduce Keyence (stock code: 6861)!

■Company Profile

・Japan’s leading manufacturer of FA sensors and other detection, measurement and control equipment..

・Market capitalization is No. 2 in Japan, second only to Toyota Motor Corporation! (As of April 5, 2023)

・Almost 60% of its sales are overseas. (Fiscal year ending March, 2022)

■Financial Performance and Financial Condition

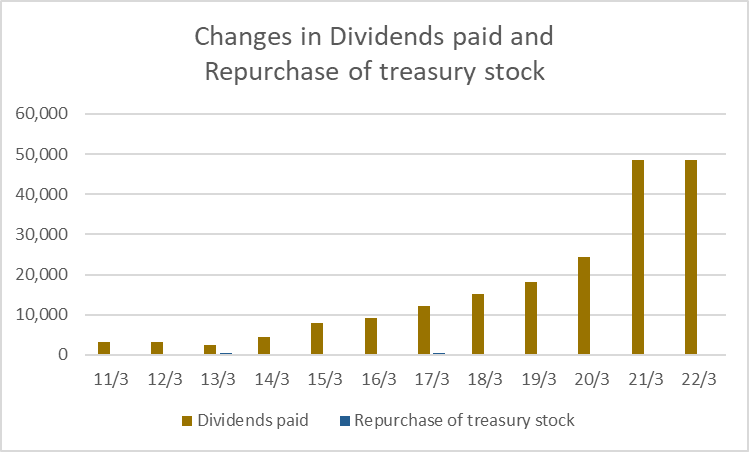

The following amounts are in “millions of yen”.

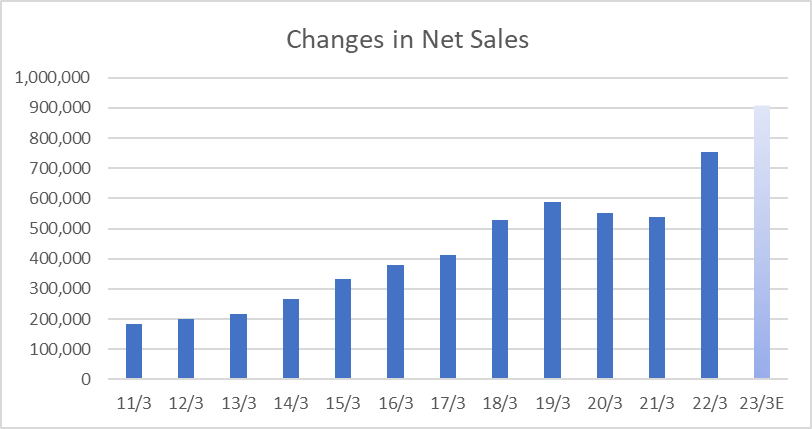

・Net Sales

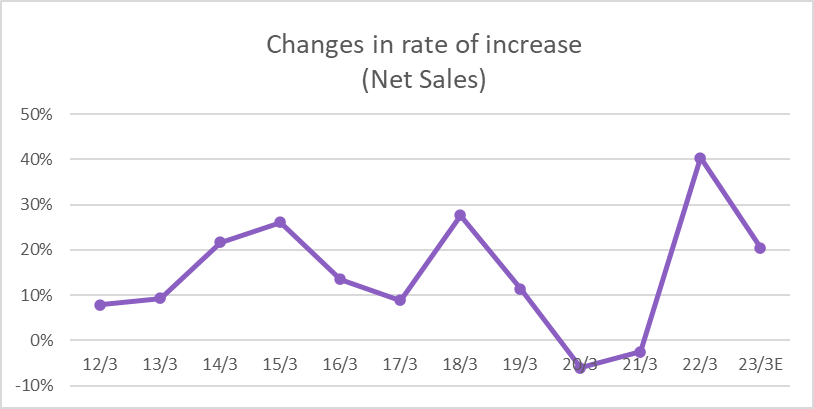

・Rate of Increase (Net Sales)

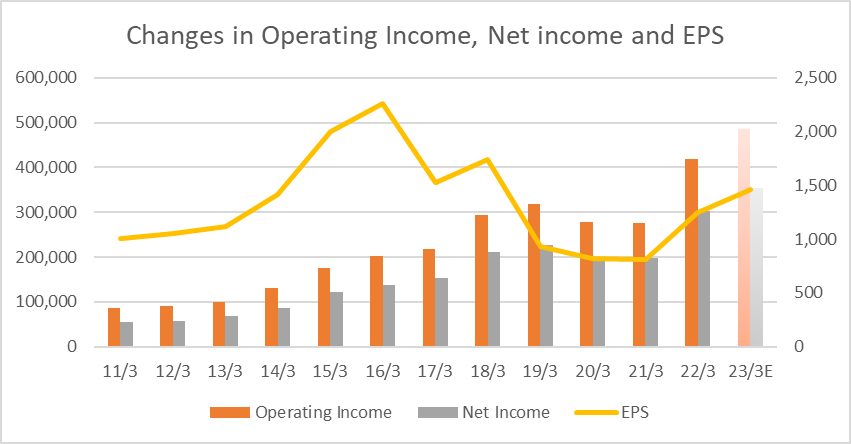

・Operating Income, Net Income and EPS

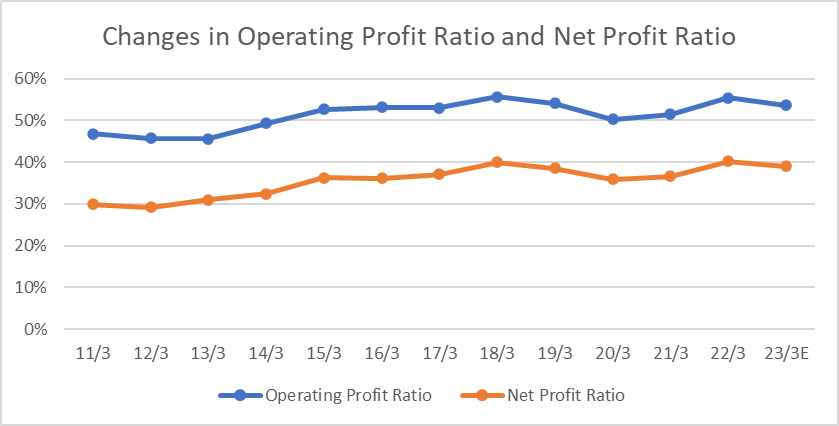

・Operating Profit Ratio and Net Profit Ratio

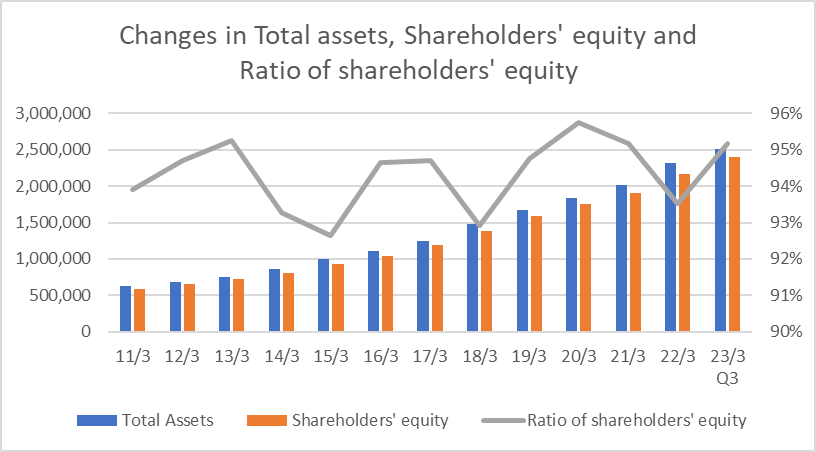

・Total assets, Shareholders’ equity and Ratio of shareholders’ equity

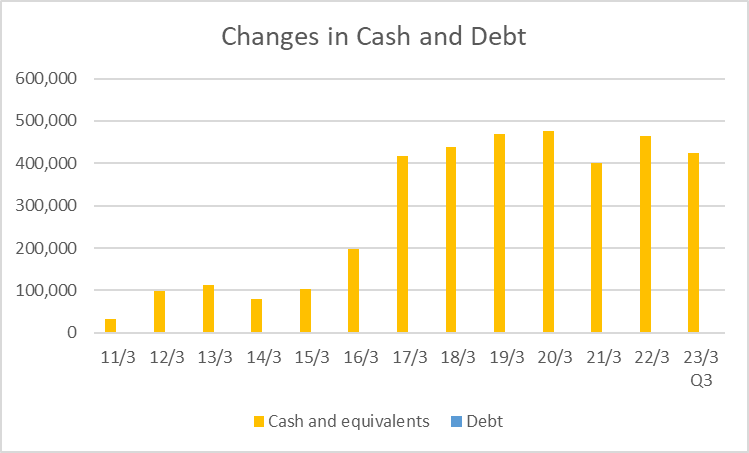

・Cash and Debt

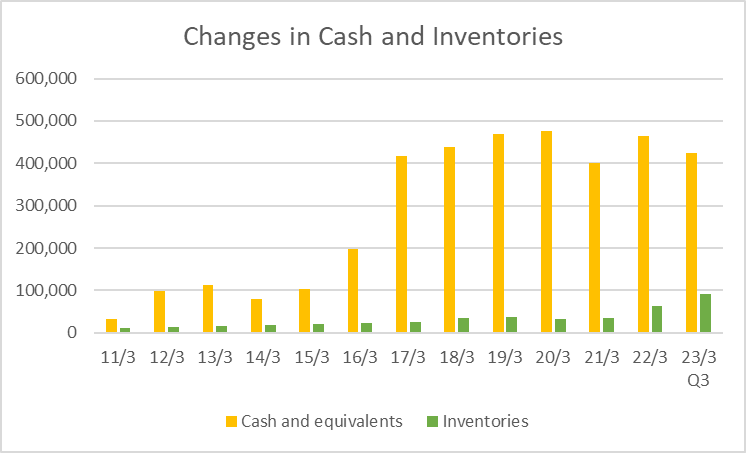

・Cash and Inventories

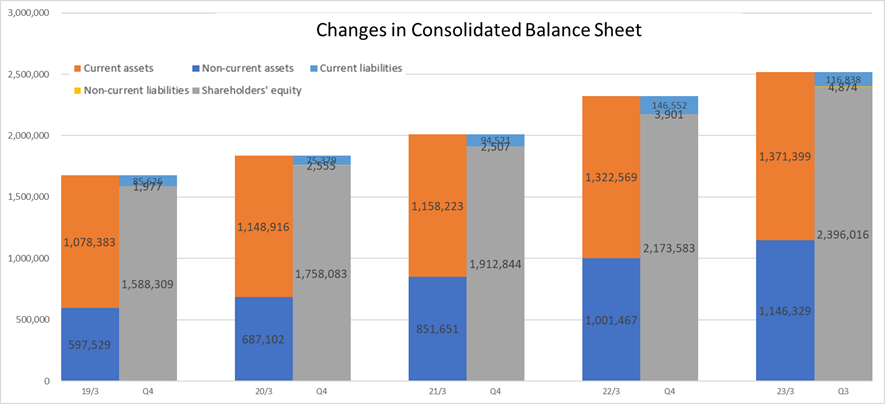

・Consolidated Balance Sheet

・Dividends and Repurchase of treasury stock

■Stock Price Information(Closing price on Apr 5, 2023)

Stock Price : 62,020 JPY

PER (Forecast) : 42.02 x

PBR (Forecast) : 6.41 x

Dividend yield (Forecast) : 0.48%

Thank you for reading!

I wish you success with your investment!

コメント